Chase Wire Transfers: Fees, Limits, & How-To Guide

Are you looking for a swift, secure, and efficient way to move money, both domestically and internationally? Wire transfers, facilitated by institutions like Chase Bank, offer a reliable solution for transferring funds across various financial institutions and borders. This guide delves into the specifics of Chase wire transfers, providing you with the knowledge to navigate the process seamlessly, from initiating a transfer to understanding the associated fees and timelines.

The ability to send and receive money electronically has become an indispensable part of modern finance. Whether its for paying international tuition fees, supporting family abroad, or settling a business transaction, wire transfers serve as a critical tool. Chase Bank, a prominent player in the financial sector, offers various services to facilitate these transfers, ensuring that funds reach their destination securely and efficiently. This article explores the mechanics of Chase wire transfers, offering detailed instructions and insights to help you use this valuable service effectively.

Understanding Wire Transfers with Chase Bank

Chase Bank, with its extensive reach and robust financial infrastructure, provides a comprehensive wire transfer service. Customers can initiate these transfers through multiple channels, including the Chase mobile app, online banking platforms, and physical branch locations. This flexibility ensures that users can manage their financial transactions from anywhere, at any time.

- Aditi Mistry Latest Videos App More 2024

- Alyx Star Age Wiki Biography More Everything You Need To Know

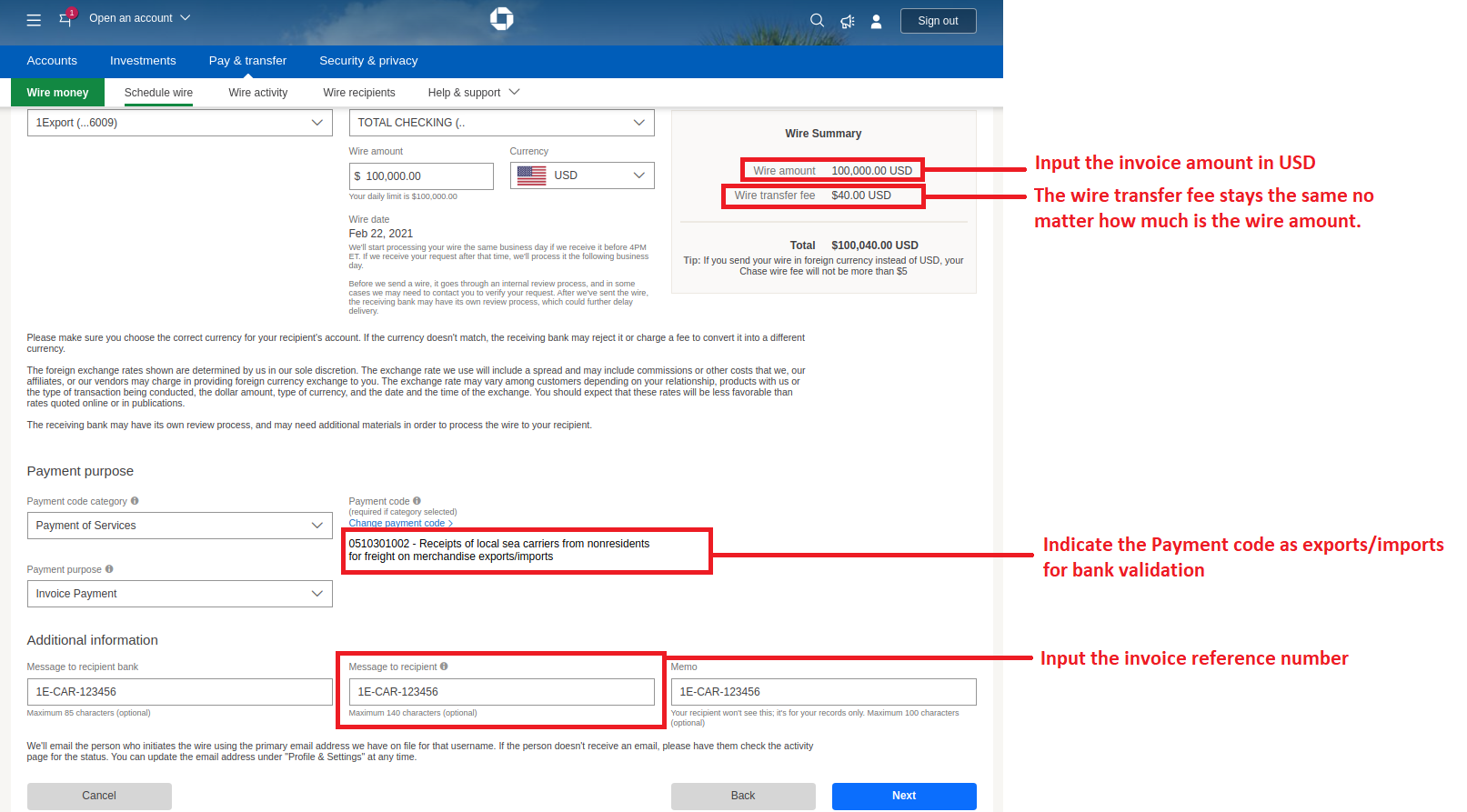

To initiate a wire transfer using the Chase mobile app, you must first sign in. Once logged in, navigate to the "Pay & Transfer" section, which is typically found in the bottom menu. From there, select "Wires and Global Transfers." The app will then guide you through the terms and conditions, prompting you to accept them before proceeding. You'll choose your checking account and then be ready to proceed with the transfer. This user-friendly process exemplifies Chase's commitment to providing accessible and straightforward financial solutions.

Chase online banking provides similar functionality, allowing users to manage their accounts, view statements, monitor activity, pay bills, and transfer funds securely. This all-encompassing service ensures that customers have complete control over their finances, facilitating both domestic and international transactions with ease.

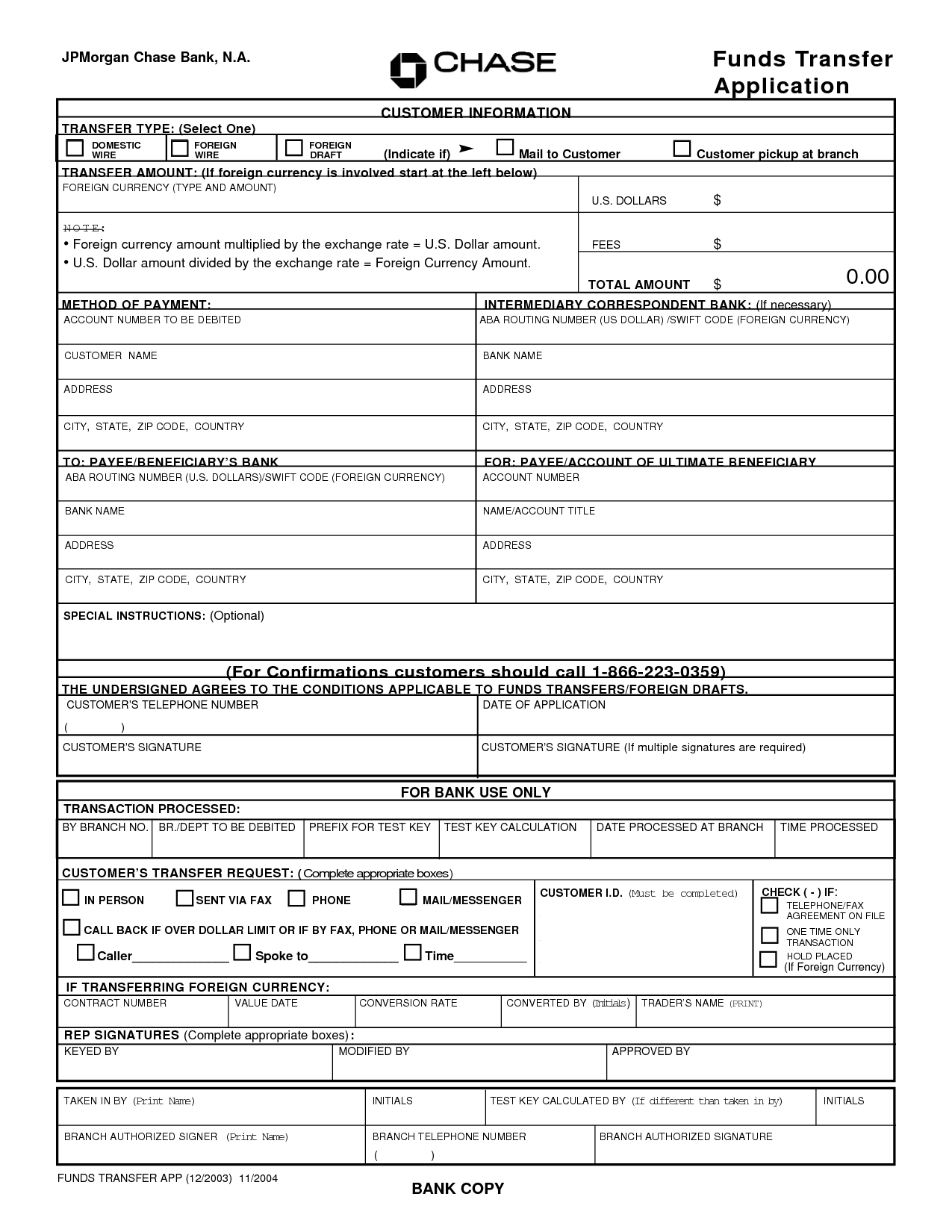

For those who prefer a more traditional approach, visiting a Chase branch allows you to initiate international wire transfers. This option is particularly useful for those who may need assistance or prefer to conduct financial transactions in person. Chases well-staffed branches offer personalized service, ensuring that all customer needs are met.

- Iot Remote Access How To Access Devices Behind Firewalls

- Jameliz Benitez Smith Bio Age More Unveiling The Social Media Star

A key aspect of understanding wire transfers involves knowing the specific details required to execute a transaction. This includes the recipient's name, the recipient's bank name, the recipient's account number, and the bank's routing number. For international transfers, you'll also need the SWIFT code or IBAN (International Bank Account Number) of the recipients bank. These codes are essential for ensuring that funds are routed correctly and securely. Chase provides resources to help you gather these details, often through its customer service channels and online banking platforms.

One of the essential steps in any wire transfer is verifying the recipient's information. Confirming the routing number with the recipient's bank is crucial to prevent delays or misdirected funds. Also, be aware that a financial institutions routing number for wire transfers may differ from its checking or savings account routing number. This distinction ensures that transactions are processed efficiently and accurately.

Chase also emphasizes security to safeguard users against fraud and scams. The bank dynamically determines transfer limits for each external transfer based on internal criteria when you schedule the transfer. The maximum daily limit will be displayed when you set up the transfer. Understanding these limits is important for ensuring that transactions can proceed smoothly and without unexpected restrictions.

While Chase provides a reliable wire transfer service, comparing it with other providers, such as Wise (formerly TransferWise), may offer potential cost savings. Wise, for example, often provides cheaper and faster international payment options. Comparing fees and exchange rates can help users optimize their financial transactions, making them more cost-effective.

Chase Bank Wire Transfer Fees and Processing Times

Understanding the fees associated with wire transfers is crucial for budgeting and financial planning. Chase Bank charges fees for both incoming and outgoing wire transfers. These fees can vary depending on the type of transfer (domestic or international) and whether the transfer is initiated online, through the mobile app, or in a branch.

For domestic wire transfers, Chase typically charges $25 for outgoing transfers and $15 for incoming transfers. However, some fees may be waived if the transfer is initiated online, through the mobile app, or with the assistance of a Chase banker. The exact pricing details can be found on the Chase website or by contacting customer service.

International wire transfers involve slightly different fee structures, and these also depend on whether the transaction is incoming or outgoing. The specifics of these fees can be obtained from Chases official sources, or by speaking directly with a customer service representative.

Processing times are also an important factor when considering wire transfers. Domestic wire transfers usually complete within 24 hours, meaning the funds are typically deposited into the recipients account on the same day. International wire transfers, however, may take longer due to the involvement of multiple financial institutions and the need for compliance with international regulations. Chase strives to process these transfers as quickly as possible, but users should be prepared for a processing time of several business days. The exact timing can vary depending on the destination country and the financial institutions involved.

Wire transfers are a swift way to transfer money, with the potential for funds to be available within minutes in some cases. Chase uses a separate routing number for wire transfers to ensure they are processed faster. This dedicated routing number is crucial for efficient transaction processing.

How to Initiate a Chase Wire Transfer

Initiating a wire transfer through Chase is straightforward, thanks to the bank's user-friendly online and mobile platforms. Here's a step-by-step guide:

- Log in to Your Account: Access your Chase online banking account via the website or mobile app.

- Navigate to Payments & Transfers: Once logged in, locate the "Payments & Transfers" section, where you will find the option to initiate a wire transfer.

- Select Wire Money: Choose the option to wire money. You will then be prompted to enter details about the recipient.

- Enter Recipient Information: This includes the recipients name, address, bank name, account number, and the bank's routing number. For international transfers, you will also need the SWIFT code or IBAN.

- Specify the Amount: Enter the amount you wish to transfer in U.S. dollars (USD) and select the currency you want the recipient to receive (if different).

- Review and Confirm: Carefully review all the details to ensure accuracy. Once confirmed, the funds will be transferred.

The Chase mobile app provides a particularly convenient way to send wire transfers. After signing in, tap the menu in the top left corner and select "Chase Global Transfer." From there, you will specify whether the recipient is an individual or a business and indicate their country. Enter the amount of your wire transfer in U.S. dollars and tap "Next." The app then guides you through the remaining steps, making the process seamless and efficient.

For those who prefer to initiate a wire transfer in person, you can visit any Chase branch. Authorized signers on the account can initiate wire transfers at the branch, ensuring personalized assistance and support. This method is particularly helpful for individuals who may need assistance completing the transaction or those who prefer direct, face-to-face interaction.

Locating Your Chase Bank Routing Number

The routing number, also known as the ABA (American Bankers Association) routing number, is crucial for wire transfers. It identifies Chase Bank and directs the transaction to the correct destination. Finding the correct routing number is easy using various resources.

You can find the routing number by referring to the state in which your account was opened. The table provides information on the appropriate routing numbers, categorized by state, region, and transfer type. This is the most accurate and reliable method. The table below provides a comprehensive list of routing numbers affiliated with Chase Bank, categorized by state, region, or transfer type.

Additional methods for locating your Chase Bank routing number include using the Chase app, contacting customer service, or consulting the Federal Reserve Directory. These options provide alternative ways to obtain the correct routing information, ensuring a smooth and accurate transfer process.

Remember that the routing number for wire transfers may not be the same as the routing number used for checking or savings accounts. The dedicated routing number ensures faster and more efficient processing of wire transactions. Always confirm the routing number with your bank or financial institution before initiating a wire transfer to prevent delays or errors.

Chase Wire Transfer Limits

Chase implements transfer limits to protect users from fraud and scams. These limits vary based on factors like the transfer type and account specifics. Chase dynamically determines the limit for external transfers based on internal criteria at the time the transfer is scheduled.

The maximum daily limit applicable to you will be displayed when you set up the transfer, ensuring transparency. This limit can vary, and your other bank may have a different transfer limit. It's essential to understand these limits to avoid any unexpected issues during a wire transfer.

The table below provides an overview of key information related to Chase wire transfers, including fees, processing times, and available channels. Understanding these components is critical for planning and executing wire transfers effectively.

Chase Bank Wire Transfer - Essential Information

Here is the table that you have requested regarding the "Chase Bank Wire Transfer".

| Category | Details | Additional Information |

|---|---|---|

| Service Overview | Allows sending and receiving money electronically within the U.S. and internationally. | Offers a secure and efficient way to transfer funds for various purposes. |

| How to Initiate | Through Chase mobile app, online banking, or at a Chase branch. | Step-by-step guides available on the Chase website and within the app. |

| Domestic Transfers | Usually deposited within 24 hours. | Requires recipients name, bank name, account number, and bank routing number. |

| International Transfers | Can be initiated via branch or digital banking services. | Requires recipient's name, address, bank name, account number, SWIFT/BIC code, and country. |

| Fees (Domestic) | Outgoing: $25; Incoming: $15 (may vary). | Fees may be waived when initiated via certain methods. |

| Fees (International) | Varies based on destination and other factors. | Check Chases website or contact customer service for current rates. |

| Routing Number | Varies based on the state where the account was opened. | Use the Chase app, online banking, or contact customer service to find the correct routing number. |

| Transfer Limits | Limits depend on the transfer type and account specifics. | The maximum daily limit is displayed during setup. |

| Additional Features | Ability to send mobile payments to over 90 countries. | Chase Global Transfer feature for international payments. |

| Security | Dynamic limits to protect against fraud. | Follow security protocols and confirm information before transferring. |

| Customer Support | Available via phone, online chat, and in-branch. | Contact Chase customer service for questions and complaints. |

This table highlights the key features and considerations for utilizing Chase wire transfer services, ensuring a clear and accessible guide to understanding the process. Remember to confirm all details and verify fees and limits before initiating a transaction.

Additional Resources and Support

Chase provides several resources to help you understand and manage your wire transfers effectively. The banking education center on the Chase website offers detailed information and guides on various banking services, including wire transfers. This resource can help you learn more about the process and understand the associated costs and procedures.

For any questions or concerns, you can contact Chase customer service. Their representatives are available to assist you with inquiries, complaints, or any feedback related to wire transfers. You can also visit a local Chase branch for in-person assistance.

Understanding wire transfers is crucial for managing your finances effectively, especially when dealing with domestic and international transactions. Chase Bank offers comprehensive services, providing multiple channels for initiating transfers and ensuring secure, reliable transactions. By using the information provided in this guide, you can confidently navigate the wire transfer process and manage your finances with ease.

- Masahub2com Review Is It Safe Your Experience

- Unraveling The Truth Two Babies One Fox Controversy More

![Chase Bank Wire Transfers (How to Send, Fees, Routing Numbers) [2021]](https://www.uponarriving.com/wp-content/uploads/2018/08/Chase-routing-number.png)

Chase Bank Wire Transfers (How to Send, Fees, Routing Numbers) [2021]

Cross Border Payment How to use Wire Transfer using Chase Bank Blog

Chase Bank Wire Transfer Wire Transfer