Chase Wire Transfers & Banking: Fees, Routing Numbers & More

Are you looking for a secure and efficient way to manage your finances, make payments, and transfer funds both domestically and internationally? Chase Bank offers a comprehensive suite of services designed to meet a wide range of financial needs, providing customers with a convenient and reliable platform for managing their accounts and moving money globally.

Chase online provides a user-friendly interface for managing your accounts, viewing statements, monitoring activity, and securely paying bills or transferring funds from a central location. For those seeking to delve deeper into banking education, the Banking Education Center offers a wealth of resources. Should any questions or concerns arise, Chase customer service is readily available to provide assistance, and feedback regarding complaints is welcomed.

Chase's wire transfer services, accessible exclusively to Chase account holders, are a standout feature. With these, you can learn about the features, pricing and ease of use of these transfers. Wire transfers are an established method for moving funds, offering a reliable channel for sending large sums, whether domestically within the U.S. or to international recipients. However, comparing Chase with other money transfer options, such as Wise, becomes essential, particularly for international payments. Wise often presents a more cost-effective and faster alternative.

- Watch Bollywood Dreams Free Movies Streaming Options

- Where To Watch Movies Online Stream Download Now

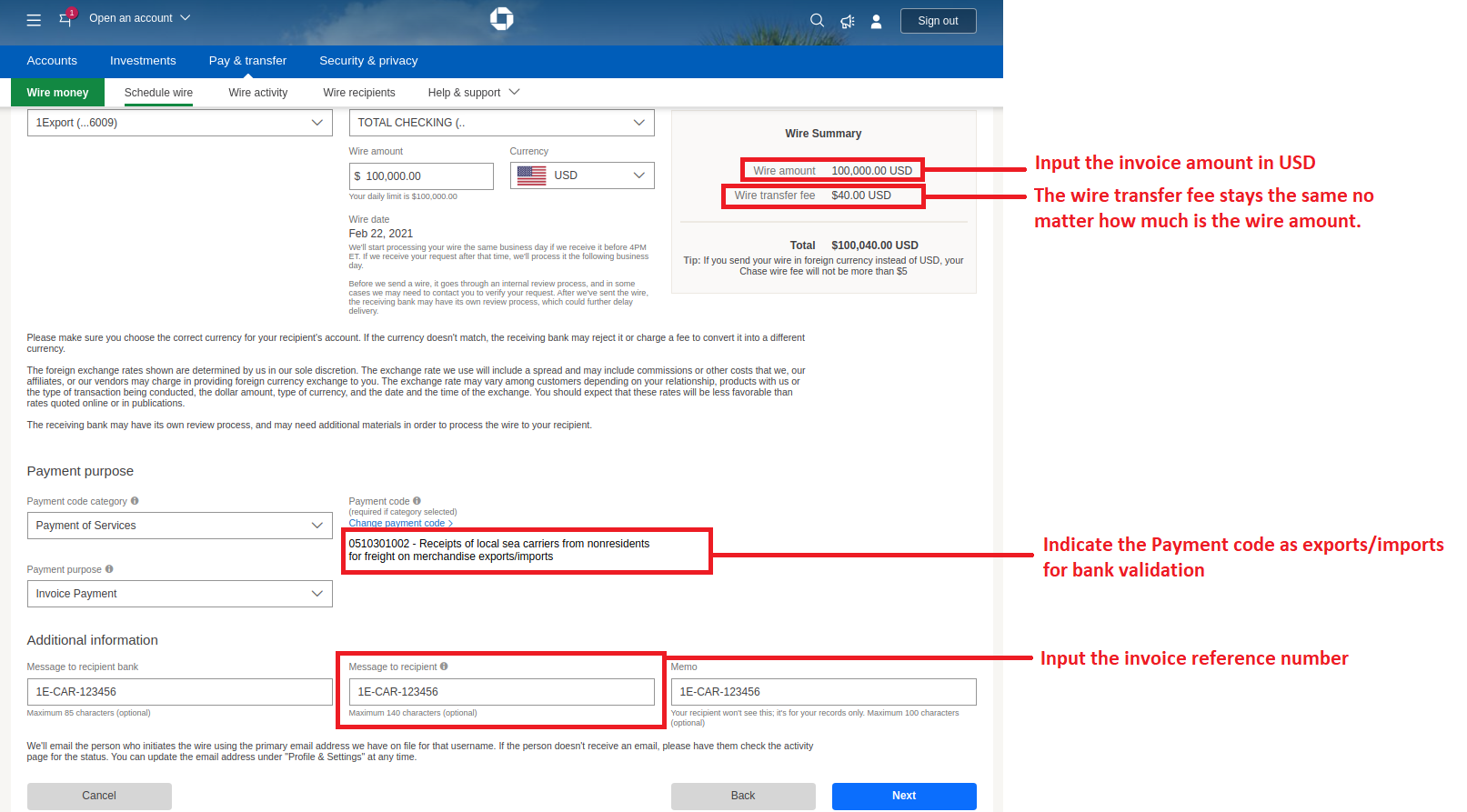

If you need to initiate a funds transfer payment, an authorized signer for your account may initiate funds (wire) transfers at any Chase branch. To get to grips with the process, it's useful to learn how to wire money online with Chase, understanding associated fees, exchange rates, and the typical transfer times for both domestic and international transfers. Additionally, understanding how to send and receive wire transfers with Chase Bank is key. This includes being familiar with domestic and international fees, the importance of routing numbers, swift codes, and IBANs.

To get familiar with the process to find your chase bank routing number depending on the state where you opened your account and the type of transfer you need. For wire transfers, Chase Global Transfer is a great resource, providing swift and secure ways to move money worldwide. Chase also provides support for business owners, with the Chase Business Banker who can provide guidance.

Heres what you need to know about how to wire money. Wire transfer services usually require you to pay the funds in person when filling out the request form. Transfer fees for wire transfers may be based on the outgoing dollar amount, location, and more. The recipient is usually contacted by the wire transfer service once the wire transfer is complete. It's worth noting that a wire fee is not charged when you send a wire in foreign currency (FX) using the Chase Mobile app or Chase.com to a bank outside the U.S., provided the amount is equal to or exceeds $5,000 USD. For amounts less than $5,000 USD, a $5 fee per transfer applies.

- Aagmaal What You Need To Know About The Ott Platform

- James Carville Mary Matalin The Untold Story Of Their Marriage

Use your Chase account to send international wire transfers across the globe, including mobile payments to over 90 countries. Use the chase app to send international wire transfers across the globe, including mobile payments to over 90 countries. In this guide, well take a look at everything you need to know about Chase international wire transfers, including transfer fees, limits, and rates. You can use wire transfers to send large sums from your bank account to another. But fees can vary from $0 to $50 or more. The Chase private client checking account doesnt charge for outgoing wire transfers. But the account requires at least $150,000 with the bank for it to be linked to a chase. To send a Chase international wire, you can visit a branch or enroll in digital banking services to send money online and in the app.

To help protect you from fraud and scams, Chase dynamically determines the limit for each external transfer(s) based on internal Chase criteria at the time you schedule the transfer. The maximum daily limit applicable to you will be displayed at the time you set up the transfer.

Domestic wire transfers with Chase can usually be deposited in 24 hours. Wiring money can be a fast way to move large amounts of money within the U.S. Here's how to send a domestic wire transfer: After signing in, tap pay & transfer tap wires & global transfers choose or add your wire transfer recipient and tell us the account you would like to wire funds from. After signing in, tap the menu in the top left corner; Tap wire transfer and then schedule transfer choose or add your recipient and tell us the account you would like to wire funds from.

| Feature | Details | Additional Information |

|---|---|---|

| Account Management | Chase online platform provides a central place to manage accounts, view statements, and monitor activity. | Secure and user-friendly, offering a consolidated view of your finances. |

| Wire Transfers | Available for domestic and international transactions. | Fees may apply. Outgoing domestic wires via Chase.com or the mobile app cost $40; Foreign currency wires cost $5, or $0 for transfers of $5,000 or more. |

| Fees | Fees vary based on the type of transaction and account. | Chase Private Client accounts may waive some wire transfer fees. |

| Routing Numbers | Essential for initiating wire transfers. | Vary by state and can be found on the Chase website or through the Chase mobile app. |

| Swift Codes | Needed for international wire transfers. | Chase's swift code is used when an IBAN is requested. |

| Transfer Limits | Dynamic limits are determined by Chase to protect against fraud. | Limits are shown when setting up a transfer. |

| Mobile App | Allows sending domestic and international wires. | Includes features like adding recipients and scheduling transfers. |

| Customer Service | Provides assistance with account-related questions and complaints. | Easily accessible through the Chase website or mobile app. |

| Education Center | Offers information on banking and financial topics. | Helps customers learn more about various financial services. |

| Account Types | Various account options are available. | Including Personal checking accounts, Chase secure checking, Chase total checking, Chase premier plus checking, Chase sapphire checking, Chase private client checking, Chase first checking, and Chase high school checking. |

Learn More at Chase.com

- Theodore Barrett Hoax The Onions Viral Video Explained Factcheck

- Watch Tamil Web Series 2025 On Ullu Drama Romance More

Cross Border Payment How to use Wire Transfer using Chase Bank Blog

How To Send A Wire Transfer On Chase (How To Set Up Wire Transfer On

How to Activate Wire Transfer on Chase Bank !! Wire Transfer from Chase